Currently Empty: ₹0.00

The CA Intermediate course is the second stage of the Chartered Accountancy program in India, managed by the Institute of Chartered Accountants of India (ICAI). It’s designed to build on the foundational knowledge gained in the CA Foundation course and prepare students for the advanced final level. This level is crucial for developing a deep understanding of core subjects like accounting, law, and taxation, which are essential for a professional accountant.

Course Structure and Subjects

The CA Inter course consists of six papers, which are divided into two groups of three papers each. Students can appear for either group individually or both groups together. Each paper is worth 100 marks and includes a mix of subjective and objective-type questions.

Group 1

-

Paper 1: Advanced Accounting

-

Paper 2: Corporate and Other Laws

(Part I: Company Law & LLP Law, Part II: Other Laws) -

Paper 3: Taxation

(Section A: Income Tax Law, Section B: Goods & Services Tax)

Group 2

-

Paper 4: Cost and Management Accounting

-

Paper 5: Auditing and Ethics

-

Paper 6: Financial Management and Strategic Management

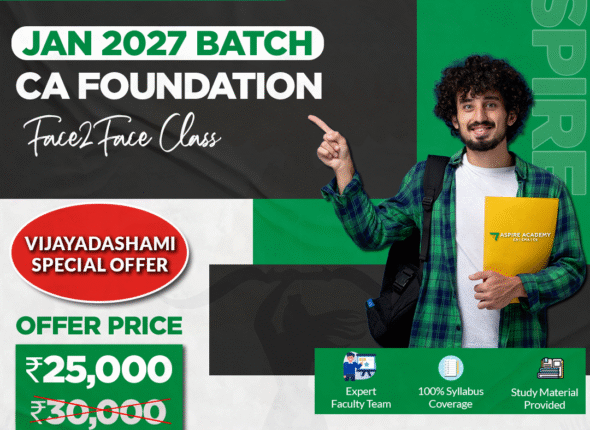

(Section A: Financial Management, Section B: Strategic Management)Following the ICAI materials with the rigour they demand. This focused environment ensures every question is heard, every doubt is clarified on the spot, and your progress is personally monitored. Join our face-to-face classes starting in January 2027 and take the definitive first step towards your CA dream with the confidence that only personalized mentorship can provide.

Course Content

Paper 1: Principles and Practice of Accounting

-

Chapter 1: Theoretical Framework

-

Chapter 2: Accounting Process

-

Chapter 3: Bank Reconciliation Statement

-

Chapter 4: Inventories

-

Chapter 5: Depreciation and Amortisation

-

Chapter 6: Bills of Exchange and Promissory Notes

-

Chapter 7: Preparation of Final Accounts of Sole Proprietors

-

Chapter 8: Financial Statements of Not-for-Profit Organisations

-

Chapter 9: Accounts from Incomplete Records

-

Chapter 10: Partnership and LLP Accounts

-

Chapter 11: Company Accounts